Tallyman Axis is a popular debt management software used by Axis Bank to streamline its loan recovery process. With the increasing number of customers and financial transactions, managing overdue payments, recoveries, and maintaining customer relations has become crucial for banks. Axis offers a robust solution, helping Axis Bank stay ahead in managing its debt portfolio efficiently. In this article, we will delve into the significance of Axis, its features, and how it simplifies debt management for Axis Bank. We will also cover key aspects related to “Axis bank,” “Axis login,” and “Tallyman Axis bank login.”

What is Tallyman Axis?

Tallyman Axis is a sophisticated debt management software solution tailored to financial institutions like Axis Bank. It helps in automating, streamlining, and simplifying debt collection processes, ultimately reducing the cost of managing overdue payments. By integrating customer data, Tallyman provides Axis Bank with real-time insights into the debt cycle, customer behavior, and repayment patterns.

Key Features of Tallyman Axis:

| Feature | Description |

| Automation | Automates repetitive tasks in debt collection, such as reminders and invoicing. |

| Real-Time Analytics | Provides data insights for tracking collection performance and trends. |

| Customer Relationship Management | Manages customer interactions, improving relationships during debt collection. |

| Customizable Workflows | Allows businesses to design and implement tailored collection strategies. |

| Compliance Management | Ensures adherence to industry regulations through automated checks and audit trails. |

| Reporting Tools | Offers customizable reports to analyze delinquency rates, payments, and trends. |

| Integration | Integrates with third-party software such as CRM and ERP systems. |

| Security | Implements encryption and security protocols to protect customer data. |

| Customer Support | Provides dedicated support to help businesses with platform use. |

Why Axis Bank Uses Tallyman Axis

Axis Bank employs Axis to ensure seamless management of its credit and recovery processes. Handling overdue payments can be challenging, especially for a large financial institution. The software’s ability to handle multiple debt portfolios across customers, both retail and corporate, makes it an ideal choice for Axis Bank.

Benefits of Tallyman Axis for Axis Bank:

- Increased Efficiency: Automates debt management, reducing the need for manual intervention.

- Improved Collection Rates: Provides actionable insights into customer behavior, improving repayment rates.

- Reduced Operational Costs: Decreases the resources required for tracking overdue payments.

- Real-Time Reporting: Offers real-time reports on outstanding debts, ensuring better decision-making.

- Enhanced Customer Communication: Allows personalized communication strategies with delinquent customers, improving customer relations.

Tallyman Axis Bank Login Process

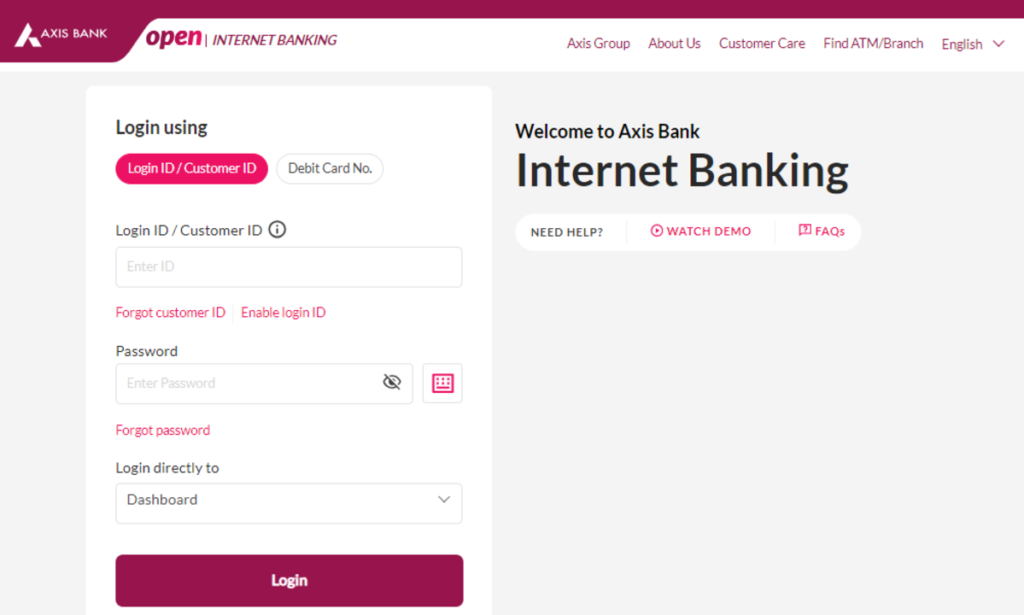

To access the system, users (primarily bank staff) need to go through the Axis login portal. This portal provides secure access to the debt management system, enabling authorized personnel to manage customer accounts, track overdue payments, and monitor collections.

Steps to Login to Tallyman Axis Bank:

- Visit the Official Axis Bank Portal: Employees of Axis Bank can log in through the official Axis Bank portal.

- Enter Your Credentials: Input your employee ID and password provided by the bank.

- Access the Dashboard: Once logged in, the Tallyman dashboard will display all necessary information about customer accounts and outstanding debts.

- Navigate Through Modules: The dashboard allows you to navigate through different modules like overdue payments, communication logs, and customer profiles.

- Log Out Securely: Always log out after usage to ensure the security of customer data.

How Tallyman Axis Bank Login Works

This Bank offers seamless access to Tallyman through its secure banking system. The login process involves multi-factor authentication (MFA), ensuring the safety of customer data and sensitive debt information.

Features of Tallyman Axis Login:

- Secure Access: Uses MFA to ensure data protection.

- Role-Based Access: Different levels of access depending on the user’s role within the bank.

- Data Encryption: Ensures all data is encrypted during login sessions.

- User-Friendly Interface: Easy navigation for Axis Bank employees.

- Mobile Compatibility: Accessible through both desktop and mobile devices for convenience.

Tallyman Axis Bank in Debt Recovery

Axis Bank’s adoption of axis for its debt recovery process has streamlined how the bank handles overdue payments. The software allows the bank to engage with customers through personalized strategies based on customer profiles and debt amounts. This has significantly improved Axis Bank’s recovery rates, enabling better management of bad debts and non-performing assets (NPA).

How Tallyman Axis Helps in Debt Recovery:

- Segmenting Customers: The software classifies customers based on their repayment history, allowing Axis Bank to tailor its recovery efforts.

- Communication Strategy: With personalized reminders and communication tools, the bank can reach customers more effectively.

- Automated Reminders: Tallyman sends automatic reminders to customers, reducing the likelihood of missed payments.

- Tracking Legal Cases: For cases that involve legal action, Tallyman provides a module to track the progress and documentation.

The Axis bank login is crucial in this process as it enables authorized staff to access sensitive debt-related information, ensuring that recovery strategies are implemented without delay.

Challenges Faced Without Tallyman Axis

Before using Tallyman, Axis Bank encountered various challenges in managing overdue payments and bad debts. The manual process was time-consuming and inefficient, resulting in delayed recoveries and increased operational costs. Furthermore, tracking customer debt profiles and repayments was complex without an automated system.

Challenges Without Tallyman Axis:

- Inefficient Debt Collection: Manual processes led to delayed collections.

- Higher Operational Costs: More resources were required for tracking overdue accounts.

- Customer Dissatisfaction: Ineffective communication strategies caused friction between the bank and its customers.

- Inaccurate Data: Manual data entry and tracking often resulted in errors.

With the introduction of Axis, these challenges have been addressed, resulting in a more streamlined, efficient, and customer-friendly debt recovery process.

Advantages of Tallyman Axis

| Advantage | Benefit |

| Automated Workflows | Reduces manual effort and speeds up the recovery process. |

| Customer Segmentation | Helps in targeting the right customers with personalized communication. |

| Reduced Costs | Lowers the cost of debt recovery through automation. |

| Real-Time Insights | Provides real-time data on outstanding debts and customer behavior. |

| Scalability | Can handle an increasing volume of customers and transactions efficiently. |

Conclusion

In conclusion, Tallyman Axis has revolutionized how Axis Bank manages its debt recovery process. By automating various aspects of debt management, from customer communication to real-time tracking, the bank can now focus on improving customer satisfaction while ensuring timely recoveries. The secure Axis bank login system ensures that only authorized personnel can access sensitive information, safeguarding the bank’s and customers’ data.

Axis has not only increased efficiency but also reduced operational costs for Axis Bank, allowing it to maintain a competitive edge in the financial industry. With continued advancements in debt management technology, Axis Bank is well-positioned to navigate the complexities of modern-day financial services.

FAQs

Q1. What is Tallyman Axis?

Tallyman Axis is a debt management software used by Axis Bank to manage overdue payments, automate collections, and improve recovery rates.

Q. How does the Axis login work?

Employees of Axis Bank can log in to the system using their employee credentials through the secure Tallyman Axis login portal.

Q. Is Tallyman Axis secure?

Yes, the Axis bank login system uses multi-factor authentication and data encryption to ensure security.

Q. What are the advantages of Axis’ for Axis Bank?

Tallyman Axis improves efficiency, reduces operational costs, and enhances customer communication by automating debt management processes.

Q. Can customers access Tallyman Axis‘?

No, Axis is for internal use by Axis Bank employees to manage customer debts and collections.

Read Also:- Crypto Pur: A Free Recharge, Loan, and Ayushman Card Services